will capital gains tax increase in 2021

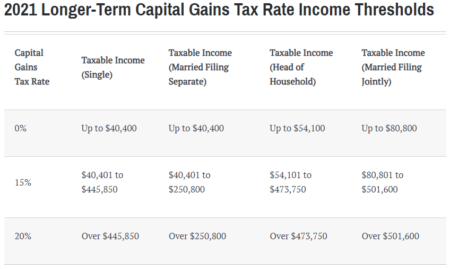

5 days ago Feb 24 2018 2021 capital gains tax calculator. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

This slowdown is largely the result of transactions that.

. Add state taxes and you may be well over 50. Bidens tax plan called for a hike in the long-term capital gains tax rate but only for the richest Americans. Joe Biden is set to propose a capital gains tax hike for the wealthiest reports said.

There are proposals to increase the top tax rate on investment gains to. The tax rate that applies to a capital gain depends on the type of asset your taxable income and how long you held the. For example for single filers the 22 tax bracket for the 2022 tax year starts at 41776 and.

Apr 23 2021 305 AM. I am filing my amended tax. Those with less income dont pay any taxes.

If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is. As proposed the rate hike is already in effect for sales after April 28 2021.

2022 capital gains tax rates. If you have a long-term capital gain meaning you held the asset for more than a year youll owe either 0 percent 15 percent or 20 percent in the 2021 or 2022 tax year. The 2022 and 2021 tax bracket ranges also differ depending on your filing status.

In 2021 and 2022 the capital gains tax rate is 0 15. The 238 rate may go to 434 an 82 increase. As mentioned earlier the IRS taxes short-term capital gains are taxed at the ordinary income tax rate.

Single taxpayers with between roughly 40000 and 446000 of income pay 15 on their long-term capital gains or dividends in 2021. The proposal would increase the maximum stated capital gain rate from 20 to 25. What Are the Capital Gains Tax Rates for 2022 vs.

In the first quarter of 2021 152 transactions were completed versus 177 in the same period in 2020 a 14 decrease. Specifically the current top. The effective date for this increase would be September 13 2021.

Note that short-term capital gains taxes are even higher. 3 hours agoThe Center Square The Citizen Action Defense Fund a local government watchdog nonprofit sent the Washington state Department of Revenue a letter demanding the. The lifetime capital gains exemption is 892218 in 2021 up from 883384 in 2020.

This means that high-income investors could have a tax rate of up to. I forgot to include my crypto gains of 400k on my 2021 tax return. The increased limit applies to all individuals even those who have previously used the.

Statistics published by HMRC in August 2022 revealed that in the 202122 tax year 129000 taxpayers reported residential property disposal using HMRCs online service filing. Capital gains tax is likely to rise to near 28 rather. Amending but will I be audited.

Forgot to include crypto capital gains 400k in 2021 tax return. Could capital gains taxes increase in 2021. 2021-2022 Capital Gains Tax Rates Calculator.

House Democrats propose raising capital gains tax to 288 Published Mon Sep 13 2021 333 PM EDT Updated Mon Sep 13 2021 406 PM EDT Greg Iacurci GregIacurci. Higher taxes on long-term capital gains now occupy a prime position on the agenda in Washington. Capital gains taxes on assets held for a year or less correspond to ordinary income tax.

What You Need To Know About Capital Gains Tax

Effects Of Changing Tax Policy On Commercial Real Estate

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Accelerating 2021 Business Sales To Avoid Biden Tax Increase

Preparing For Capital Gains Tax Increases In 2021 Diamond Associates Cpas

Rethinking How We Score Capital Gains Tax Reform Bfi

Short Term And Long Term Capital Gains Tax Rates By Income

Short Term Capital Gains Tax Rates For 2022 And 2021 Smartasset

Capital Gains Tax In The United States Wikipedia

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

Income Tax And Capital Gains Rates 2021 03 01 21 Skloff Financial Group

2 Quick Points To Simplify Capital Gains Tax By Tunji Onigbanjo Datadriveninvestor

How To Avoid Paying Capital Gains Tax Legally Capital Advantage

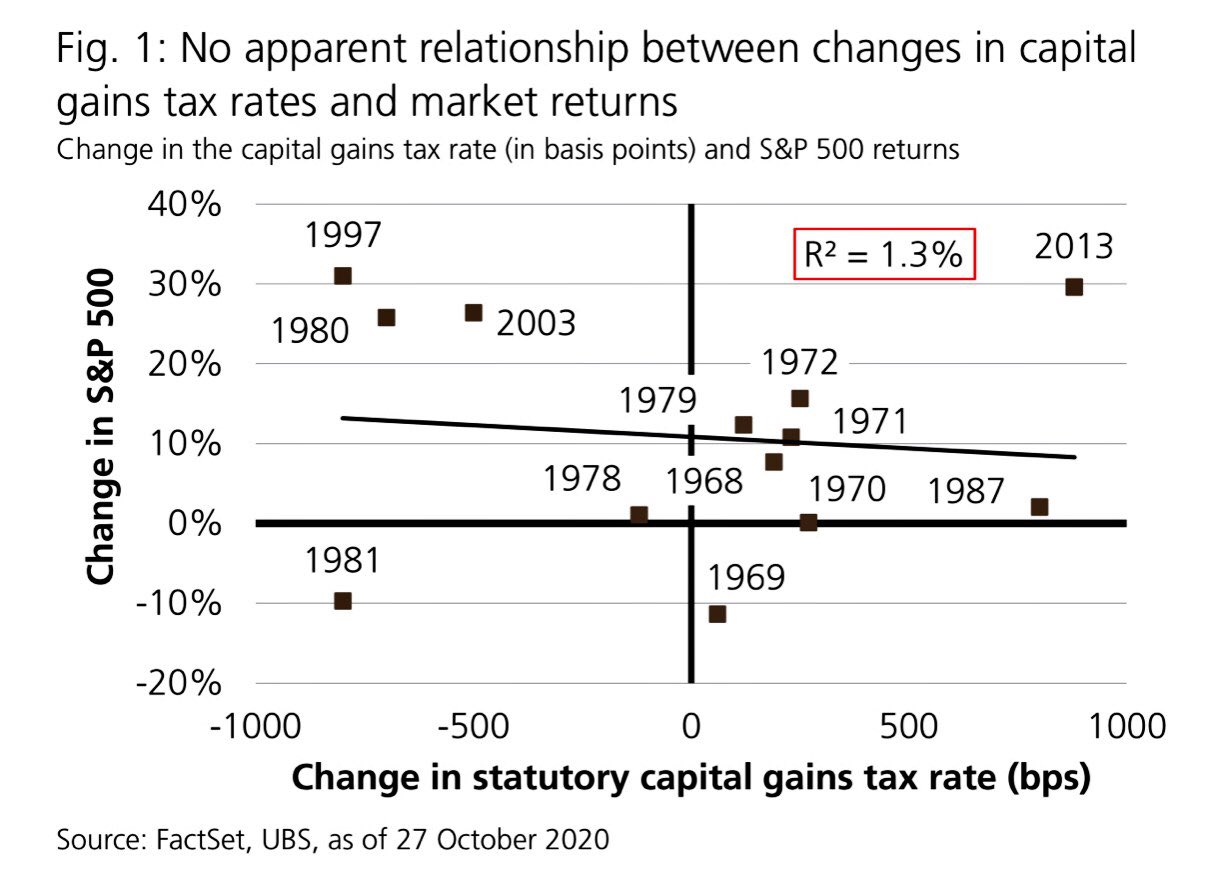

Liz Ann Sonders On Twitter Virtually No Relationship Between Changes In Capital Gains Tax Rate Amp S Amp P 500 Returns In Year Of Change Last Time Cap Gains Went Up In 2013

Hawaii Lawmakers Advance Capital Gains Tax Increase Hawaiʻi Tax Fairness Coalition

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)